Strong growth drivers abound, say industry observers, and ASPs are on the rise

LATEST NEWS FROM THE TECHWORKS ASIA TEAM

Strong growth drivers abound, say industry observers, and ASPs are on the rise

The semiconductor industry has long been plagued by the cyclical ups and downs that characterize any number of manufacturing sectors – but with a vengeance. In 2017, things are at last looking up, according to several analyst houses.

Numbers compiled by WSTS (World Semiconductor Trade Statistics), for example, indicate that the worldwide semiconductor market is expected to be up over 6% in 2017, after a record year in 2016.

“The worldwide semiconductor market was up 1.1% in 2016 to US$338.9 billion, an all time high. The year 2017 is forecast to be strong, with 6.5% growth to US$361 billion. 2018 is forecast to be up another 2.3% to US$369 billion.”

In 2017, says WSTS, strong growth drivers will include sensors, analog, and memory, with all products contributing to positive growth. All regions are forecast to return to growth in 2017.

Memorable forecast

According to market research firm IC Insights, memory will certainly be a major growth factor in 2017, and the market research firm has raised its worldwide IC market growth forecast for 2017 to 11% for the year, more than twice its original 5% outlook. “The revision was necessary due to a substantial upgrade to the 2017 growth rates forecast for the DRAM and NAND flash memory markets.”

A rise in the DRAM ASP began in 2016, according to IC Insights, driven, perhaps rather surprisingly, by the PC segment, reportedly in long-term decline: “A pickup in DRAM demand from PC suppliers during the second half of 2016 caused a significant spike in the ASP of PC DRAM. Currently, strengthening ASPs are also evident in the mobile DRAM market segment.” In 2017, says IC Insights, the trend is set to continue.

Market research organization Gartner Inc. also foresees healthy growth for the global semiconductor industry in 2017, predicting “a complete turnaround”.

“Worldwide semiconductor revenue is forecast to total US$364.1 billion in 2017, an increase of 7.2% from 2016… This represents a complete turnaround for the semiconductor industry as the market experienced 1.5% growth in 2016.”

According to Gartner, market drivers will include “…inventory replenishment and increasing average selling prices (ASPs) in select markets, particularly commodity memory and application-specific standard products.”

MEMS tech drives sensor surge

At KPMG, in commentary titled “The road to growth in semiconductors”, we are told that “Sensors/MEMS (microelectromechanical systems) jumped to the top as the sector expected to provide the strongest growth opportunity in 2017”. This statement clearly implies that although sensors as a totality will be heading market growth in 2017, the emphasis will be on MEMS as the dominant enabling technology.

Adds KPMG, “Wireless communications, IoT, and automotive are viewed as the most important applications driving revenue over the next three years.”

China – strategic re-balancing

The good news also extends to China. According to Electronics Weekly online, the indications are that China has now gone some way to re-balancing its sky-high imports of ICs with increased domestic production of semiconductor chips.

In a report entitled, “China’s Chipper Chips” (27 March, 2017), Electronics Weekly comments that, “China’s chip strategy is actually doing rather well,” noting that China’s chip imports have been flattish for the last three years while the output of the domestic chip industry has tripled. “So China is increasingly serving its own IC needs.”

“China’s domestic IC industry has tripled from US$21 billion in 2010 to US$62 billion in 2016, with IC design increasing 5X in those six years from US$5- to US$25 billion.”

China’s accelerating semiconductor production is in line with positive signals from China’s overall manufacturing sector. According to Bloomberg, in its report, “China’s Factory Gauge Climbs to Highest in Almost Five Years” (31 March 2017), increased factory production is “the latest evidence of gathering momentum in the world’s second-largest economy.”

Bloomberg adds, “The new strength follows a factory rebound since mid-2016, while industrial output and private investment also have picked up.”

Links:

https://www.wsts.org/PRESS/Recent-News-Release

http://www.gartner.com/newsroom/id/3578817

https://home.kpmg.com/us/en/home/insights/2017/02/global-semiconductor-outlook.html

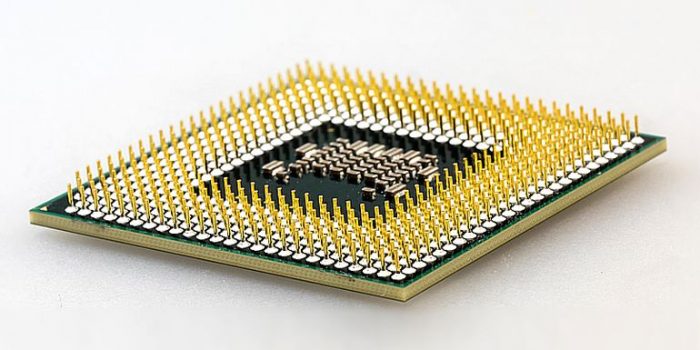

Image:

Central Processing Unit, pin-side up, courtesy of www.pexels.com, under a Creative Commons Zero (CCO) license.