Everyone is agreed that China’s rapid economic development has now slowed, but by how much? According to the World Bank, growth in China’s Gross Domestic Product (GDP) stood at 14.2% in 2007, but that has now fallen to 7.4% in 2014.

The broad macro-economic perspective sees demand for China’s exports slowing in a period of generalized global economic fragility. In his article, The lowdown on China’s slowdown: It’s not all bad, John Foley notes that when demand for exports from China slows, “A strong currency hurts, as does weak demand. But as China gets richer, it’s natural that the currency rises and that exports based on cheap labor fade away.”

Foley also notes that China’s workforce is no longer increasing in size; the pace of urbanization has slowed. Investment is less efficient. “A few years ago, only one yuan of investment was needed to add a yuan to GDP. Now it takes almost four yuan.”

How is the government of the PRC responding? The Economist Intelligence Unit (EIU), in its report, An outlook for key emerging Asian markets (29 August 2015), comments that the national government “plans to stimulate competition and productivity by drawing more private firms into sectors previously dominated by state-owned enterprises…”. Adds the report, “The government increasingly encourages capital-intensive enterprises that can improve the quality of the national industrial base, rather than labour-intensive industries. Foreign firms are also welcome in the infrastructure construction sector. The government may shy away from imported technology where there is deemed to be a local substitute.”

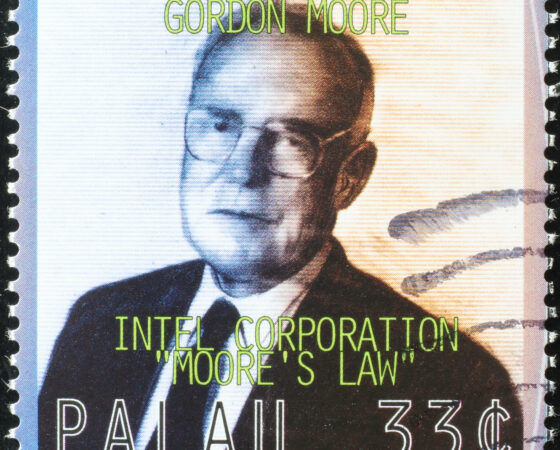

Building China’s chip industry

One of these “capital-intensive enterprises” is semiconductor production. The pseudonymous author “Overbet For Value”, writing in the online Seeking Alpha, notes that in order to drive growth over “the next few decades”, the national government is now focusing on the technology sector. “In 2014, China developed a policy in which it will invest up to 1 trillion renminbi (~US$157 billion) over the next 5-10 years across the semiconductor industry.”

Richard Kingston, VP of Market Intelligence and Investor and Public Relations at technology-IP specialist CEVA, Inc., notes, in an email interview with Barbara Ortutay of the Associated Press (AP) (26 August 2015), “Today, less than 10% of the semiconductor chips required in China are manufactured there, and this is why the Chinese government wants to develop its own industry. Rather than having to import the semiconductor chips from the US, Korea, Taiwan, Japan or other places overseas like they have traditionally had to do, our customers can now develop chips in China, with equal or better performance than those that they traditionally import from overseas.”

Comments Kingston, in an AP online article, “I believe that the strategic merit behind China’s investment in its own semiconductor industry over the next 10 years will outweigh any potential slowdown that other areas of China’s economy are experiencing.”

Alternatives to fossil fuels

China is also driving the development of forms of alternative energy, including solar PV and wind energy, as well it might, as the world’s largest importer of oil. The currently low price of oil, globally, actually benefits China, but the situation is not without its ironies. At a recent press briefing in Shanghai, at the Recycled Polyester Exhibition and Conference, local journalists indicated they were puzzled by the current market situation, in which the raw materials are sometimes cheaper than the recycled ones.

On the face of it, the low price of oil is threatening to undermine the domestic plastics recycling industry, but Kelly Xie, Head of TOMRA Sorting Recycling, China, a specialist in advanced sensor-based automated recycling systems, responded by emphasizing that the restructuring and re-regulation of China’s economy provide good opportunities for the recycling industry, and therefore for the nurturing of China’s environment, from a long-term perspective.

It’s possible that we could best view the current slowing in China as a period of “cooling the engines”. The future will still be one of growth, at rates that will remain the envy of the world, and the EIU tactfully reminds us that China will remain the world’s second largest economy. “China has a population of more than 1.3bn, and annual GDP is likely to grow to more than US$15trn (measured at market exchange rates) by 2019; by way of comparison, US GDP in 2019 is forecast at US$21.3trn.”

The EIU’s takeaway message for foreign companies: “Rising incomes [in China] will present opportunities in 2015-19. Foreign companies continue to be attracted by the opportunities offered by China’s large and growing economy.”

Links:

http://www.worldbank.org/en/country/china

http://fortune.com/2013/07/15/the-lowdown-on-chinas-slowdown-its-not-all-bad/

http://pages.eiu.com/July2015-CAAsia_Report_Registration.html

http://seekingalpha.com/article/3533516-micron-and-chinas-semiconductor-dreams